The correct HTS code for keyboard housings, keycaps, and other parts is 8473.30.51. The new Tariff schedule announced yesterday includes this category of product. This means a 10% tax immediately, rising to 25% by the end of the year on all keyboard components and other parts imported into the US from China, which will also effect (indirectly) such components sold by American companies that are sourcing all or some of their downstream components from China, even if those are purchased by consumers in other countries (including Europe and, yes, China itself). I guess it’s a shame the keyboard community doesn’t have the political clout of Apple. ![]()

I had a feeling this would be coming soon. Gird your wallets folks, we will see increases higher than 25% for downstream suppliers.

Ouch

I had prepared myself mentally for this. Just ordered a frosted acrylic Tofu case from KBDfans last night

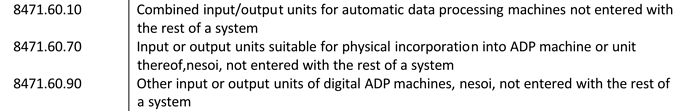

Here’s a list of ones that could be deemed ‘safe’ for now, as they aren’t on the latest round of tariffs.

Keyboards/kits could fit under these ones for sure.

8471.60.20 - Keyboards for automatic data processing machines not entered with the rest of a system

8473.10.20 - Printed circuit assemblies for word processing machine

8473.10.30 - Parts of word processing machines

The HTS term for "computer’ is “ADP” or “automatic data processing machine.” I believe that the term “word processing machine” refers to something that isn’t really made anymore, such as stenotype machines and typewriters with buffers that can be edited on an LCD display.

It’s interesting that 8471.60.20 (fully-assembled, integral keyboards) is spared from the tariffs when so many of the adjacent categories weren’t—see below. Perhaps this is the influence of Apple again.

So let’s start making typewriters?

Radio Teletype!

I don’t think that is the correct code for keycaps. I believe it is 8473.30.40.

AFaICT This is the formal ruling that established that categorization.

Download ruling 951327.doc Word document HQ 951327

Print Print this ruling preview.

HQ 951327 May 1, 1992

CLA-2 CO:R:C:M 951327 MBR

CATEGORY: Classification

TARIFF NO.: 676.54 TSUS, 8473.30.40 HTSUS; 676.54 TSUS, 8473.29.00 HTSUS; 684.58 TSUS, 8517.90.30 HTSUS; 685.90 TSUS, 8538.90.00 HTSUS; 712.49 TSUS, 9027.90.__ HTSUS

District Director U.S. Customs 909 First Ave., Rm 2039 Seattle, WA 98174

RE: Protest No. 3004-90-000198; Keytops; TSUS; HTSUS; Parts

Dear Sir:

This is our response to Protest No. 3004-90-000198, dated July 5, 1990, regarding classification of various keytops, under the Tariff Schedules of the United States (TSUS) and the Harmonized Tariff Schedule of the United States (HTSUS).

FACTS:

The instant protest includes keytops imported by Comptec International, Ltd., designed for and dedicated as parts of certain machines which include Computer/ADP machines, point of sale terminals, telephonic apparatus, control devices, automatic teller terminals, and instrumentation devices.

ISSUE:

What is the classification of various dedicated keytops under the Tariff Schedules of the United States (TSUS), and the Harmonized Tariff Schedule of the United States (HTSUS)?

LAW AND ANALYSIS:

Through discussions with the importer and an examination of samples, Customs has determined that the instant keytops are not interchangeable. From the evidence before us we have determined that each keytop is a dedicated part of a specific device, and is classifiable as such. There are no eo nomine provisions for keytops in either the TSUS or HTSUS.

The importer argues that, under the TSUS, all keytops are of the same class or kind and should be classified under the doctrine of chief use, in the provision for parts of ADP machines. However, it is Customs position that these are dedicated keytops for certain types of machines, and each type constitutes a “class” or “kind.” Therefore, for instance, there is a class of keytops that are exclusively used for ADP machines, a class of keytops that are exclusively used for telephones, etc.

Under the HTSUS, the importer again argues that Comptec’s keytops are “principally” used for ADP machines, therefore, they argue that all of Comptec’s keytops should be classifiable as parts of ADP machines.

However, classification of parts in Section XVI is governed by Legal Note 2. (a), (b), and (c) which states:

- Subject to note 1 to this section, note 1 to chapter 84 and to note 1 to chapter 85, parts of machines (not being parts of the articles of heading 8484, 8544, 8545, 8546 or 8547) are to be classified according to the following rules:

(a) Parts which are goods included in any of the headings of chapters 84 and 85 (other than headings 8485 and 8548) are in all cases to be classified in their respective headings;

(b) Other parts, if suitable for use solely or principally with a particular kind of machine, or with a number of machines of the same heading (including a machine of heading 8479 or 8543) are to be classified with the machines of that kind. However, parts which are equally suitable for use principally with the goods of headings 8517 and 8525 to 8528 are to be classified in heading 8517;

(c) All other parts are to be classified in heading 8485 or 8548.

As noted above, the instant keytops are not interchangeable. In their condition as imported, each keytop is suitable for use solely or principally with a particular type of machine, and thus, pursuant to Legal Note 2.(b), must be classified with machines of that kind. Only keytops suitable for use solely or principally with ADP machines (or units thereof) may be classified as parts of ADP machines. A finding that ADP machines may use more keytops than any other class of machines does not require that all classes of keytops are solely or principally used with ADP machines.

Therefore, we have determined the appropriate classifications for dedicated keytops to be as follows:

ADP Keyboard Keytops/Other ADP Unit Keytops…676.54 TSUS 8473.30.40 HTSUS

Point of Sale Terminal Keytops…676.54 TSUS 8473.29.00 HTSUS

Telephonic Apparatus Keytops…684.58 TSUS 8517.90.30 HTSUS

Control Device Keytops…685.90 TSUS 8538.90.00 HTSUS

Instrumentation Device Keytops…712.49 TSUS 9027.90.__ HTSUS HOLDING:

The classification of dedicated keytops is as follows: ADP Keyboard Keytops/Other ADP Unit Keytops 676.54 TSUS, 8473.30.40 HTSUS; Point of Sale Terminal Keytops 676.54 TSUS, 8473.29.00 HTSUS; Telephonic Apparatus Keytops 684.58 TSUS, 8517.90.30 HTSUS; Control Device Keytops 685.90 TSUS, 8538.90.00 HTSUS; Instrumentation Device Keytops 712.49 TSUS, 9027.90.__ HTSUS.

You should deny the protest, except to the extent reclassification of the merchandise as indicated above results in a partial allowance. A copy of this decision should be attached to the Customs Form 19 and provided to the protestant as part of the notice of action on the protest.

Sincerely,

John Durant, Director Commercial Rulings Division

That is very possible, @jesse. I have never imported keycaps, so I’ve never had occasion to get an official classification before. HTS classifications and the surrounding docs are generally horribly opaque, highly contested, and difficult to decipher, unfortunately—as the document you posted below accurately suggests.

For reference, GMK uses 8473.30.91 for their caps, which in the past has resulted in no actual import tax, just FedEx’s own processing fee of .3464%.

That code is included on the new list, unfortunately.

But GMK is German, does this tax apply for all countries?

No, the new Trump tariffs apply only to goods imported into the US from China. I just meant that using this HTS code for keycaps wouldn’t be a way around the tariffs.

Yea. I’ve been hit by this, unfortunately. Even with safe HS codes, they have automatically been hit. So you have to create a dispute which takes 120 days to hear back.

If it continues, prices may have to change. It’s a huge hit for sure.

Unrelated to China tariffs, but I have been looking for this code for a few weeks now to properly fill out my outbound international customs forms.

Maybe the keyboard community needs to send a lobbyist to DC ![]()

So, this is what getting tired of winning feels like…

So, this is what getting tired of winning feels like…

Our President is not perfect but speaking as someone who was almost homeless during the Great Recession I haven’t been this hopeful in a long time.

Think we can talk about the tariffs themselves without getting political?

Ty

I would love to see a will page or something that gives the right codes for different parts. I think I have typically used 8471.60.20 for most stuff. Anyone interested in putting a list together?